Are Stock Screeners Worth the Cost?

Stock Screeners Worth

If you’re a beginning investor, you may wonder whether stock screeners are worth the cost. After all, they don’t do the picking for you. However, they can save you time and narrow down your options to more manageable groups. Here are some things to keep in mind before making the investment. First, don’t expect to make a fortune using a stock screener alone. It’s important to remember that you must still invest your time and research.

A stock screener can’t pick the right stock for you. The best way to choose a good investment is to invest in companies that are well-known in your industry. A tech company with a low P/E valuation is unlikely to be picked by a stock screener. Furthermore, a free screener may contain ads that might distract you from the actual content. Premium screens will eliminate these ads and have more features than free versions.

A Top stock screeners can’t pick stocks based solely on their PE ratios. For example, a firm can get a one-time windfall that boosts their earnings, making them seem cheap on a PE basis. This problem can make it impossible to use a stock screener based on earnings alone. Besides, it is difficult to invest in companies with a low PE ratio. The best stock screeners should give you a mix of both.

Are Stock Screeners Worth the Cost?

A stock screener should have multiple platforms and include mobile support. This means you can manage your funds from anywhere and have access to real-time information on your phone. This allows you to seize opportunities whenever they arise. If you want a stock screener that’s able to work with you on the go, you should opt for the premium version. There’s a lot to like about a stock screener.

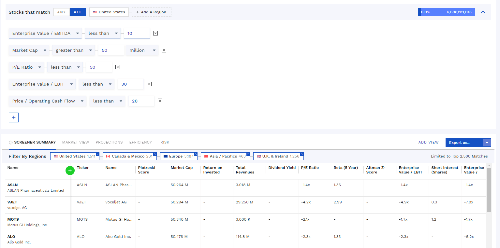

Many stock screeners are simple to use. You just need to open the app, apply your preferred filters, and wait for the results to appear on the screen. You can always add more filters as you learn more about a particular stock. A stock screener should be able to help you select the best stock among many options, but it must be worth the cost. These are the two key things to look for in a stock screening tool.

Most stock screeners use quantitative parameters for their analyses. In addition to this, they should also consider other factors that affect a company’s performance. For example, if a company has a high number of lawsuits, it may be a good idea to avoid it. These issues should be taken into account when selecting stocks. In addition to that, a stock screener should be able to predict future market trends and make predictions.