How to Cancel a Credit Card

Cancel a Credit Card

Cancelling your credit card should be done if you’ve reached the zero balance point. If your balance is higher, it would be best to pay it off and transfer it to a new card. Another reason to cancel your current card is if you’re paying an excessive interest rate. If this is the case, you can look for a balance transfer offer. Many banks have such a feature. Simply fill out an online form and a representative will call you back to confirm your cancellation.

To close your credit card account, you should contact the credit card issuer. If your balance is zero, you should contact the company to make the necessary arrangements. However, remember that residual interest may still accrue after you’ve paid your last bill. In addition to closing your account, you should also consider whether the credit card provider will offer you a new rate or rewards program. This can help you keep your current financial status.

It’s important to contact the credit provider directly to cancel your account. You should make sure that your balance is zero. If the company closed your account for some reason, you should cancel the account. A mistake in closing your account could be due to a computer glitch or the mistake of an account representative. Be sure to write a letter to the credit card issuer stating that you are no longer a customer.

How to Cancel a Credit Card

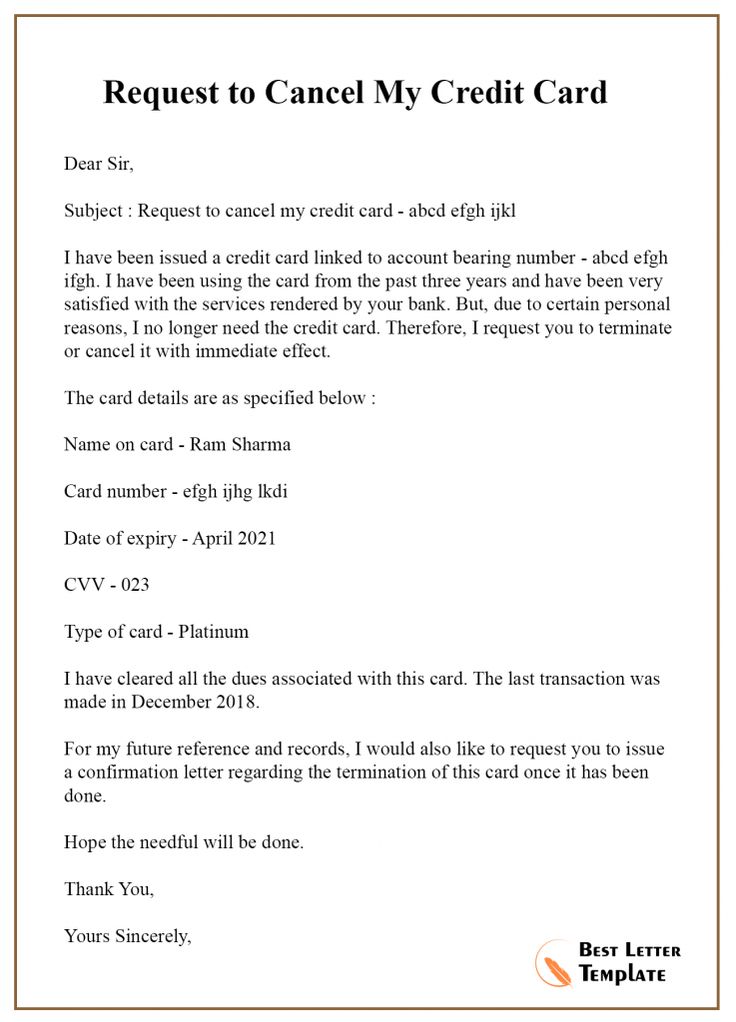

To cancel your credit card, you need to write to the credit card issuer to inform them of your decision to close it. The letter should contain your credit card’s details and be sent through regular or registered mail. The postal address of your credit card issuer can be found on their website, or you can call their customer care representatives to find out how to send your request. You should be able to get the required information quickly, so it is important to follow up on your request as soon as possible.

You can also cancel a credit card in writing by sending a written request to your credit card issuer. You should be sure to include all of your credit card information when sending a letter. You should send this letter to the address specified on the card. Your request should be received within a few weeks. You can use this letter to inform your bank of the cancellation. It is important to be prepared, and you should consider your future needs before closing your account.

Before you can cancel your credit card, you must contact your credit provider and let them know you want to close the account. The company will be able to confirm that your account is closed and will send you a letter informing you of this. You must also let them know that you will be closing your account and will not be using it anymore. After the closure, you will be responsible for any outstanding balance and may not receive any rewards.